Table: Article Outline

- 1. Introduction

- 2. Importance of Understanding Its Evolution

- 3. Early Beginnings and the Barter System

- 4. Development of Currency Systems

- 5. Birth of Banking

- 6. Regulatory Changes in Finance

- 7. Conclusion

1. Introduction

Finance, an essential aspect of our daily lives and the global economy, has a rich and complex history. Understanding its evolution not only provides insights into our current financial systems but also prepares us for future changes.

2. Importance of Understanding Its Evolution

Understanding the evolution of finance is crucial for several reasons. Firstly, it provides context for the current financial systems and practices. By looking at how finance has developed over time, we can better understand the reasons behind certain financial structures and principles. Secondly, this knowledge helps in anticipating future trends and changes in the financial world. As history often repeats itself, learning from past financial successes and failures can guide current and future financial decision-making. Finally, the evolution of finance reflects broader economic, technological, and social changes, offering insights into how finance interacts with and influences other aspects of society.

3. Early Beginnings and the Barter System

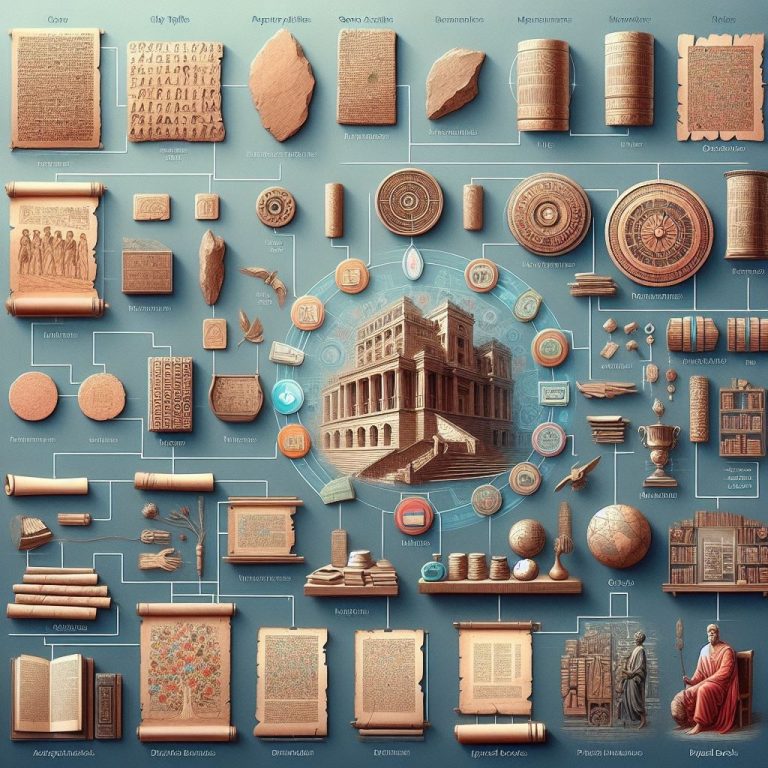

3.1 Origins of Trade and Commerce

Trade and commerce have ancient roots, dating back to when human societies first started exchanging goods and services. This era marked the dawn of the barter system, where people traded items directly without a standardized medium of exchange. Bartering was based on the mutual needs of the parties involved – for instance, a farmer might trade grain for tools from a blacksmith. This system was fundamental in fostering early economic relationships and community interdependence.

3.2 Limitations and Transition to Currency

While the barter system facilitated the initial trade, it had notable limitations. The primary issue was the need for a ‘double coincidence of wants’ – finding someone who not only had the item you wanted but also desired what you were offering. As societies grew and trade expanded, these limitations became more pronounced, leading to the need for a more efficient system.

This necessity led to the creation of currency, a revolutionary step in the evolution of finance. Early currencies took many forms, from shells to metal coins, and eventually to paper money. The introduction of currency simplified trade, allowed for the storage of wealth, and laid the groundwork for the development of modern financial systems. It represented a significant shift from direct trading to the use of a universally accepted medium, facilitating broader and more complex economic interactions.

4. Development of Currency Systems

The development of currency systems was a pivotal moment in financial history. After transitioning from the barter system, various civilizations began creating their own forms of currency. This period saw the use of objects like shells, beads, and metals as mediums of exchange. Gradually, these forms evolved into more standardized and recognized units, like coins stamped with symbols or figures to denote authenticity and value.

The use of metals like gold and silver became widespread due to their durability, rarity, and universal appeal. The concept of paper money originated in China during the Tang Dynasty and later spread to other parts of the world. This evolution from tangible items like gold to paper notes represented a significant shift in trust and value perception, laying the groundwork for modern currency systems. It facilitated trade over larger distances and among more significant numbers of people, becoming a cornerstone of expanding economies.

5. Birth of Banking

The birth of banking is closely tied to the development of currency. As trade expanded, the need for safe storage of money and valuable items led to the emergence of banking institutions. Initially, these were often temples or palaces in ancient societies, as they were considered secure and sacred places.

The concept of lending money at interest also emerged during this period. In ancient Mesopotamia and Greece, temples loaned money to traders and farmers. The modern banking system began to take shape in medieval Italy, where prominent families like the Medici started offering more sophisticated financial services. This included exchanging different currencies and administering loans, a significant development that laid the foundation for contemporary banking practices, including the creation of checking accounts, issuance of loans, and the management of credit.

6. Regulatory Changes in Finance

Role of Regulatory Bodies

Regulatory bodies play a pivotal role in shaping and safeguarding the financial landscape.

In an ever-evolving financial world, these entities establish rules and guidelines to ensure fair play, transparency, and stability. They monitor financial institutions, enforce compliance, and implement policies to protect consumers and investors. Regulatory bodies can vary from country to country, but their overarching goal remains the same: to maintain the integrity of financial markets and promote confidence among stakeholders.

Some of the most prominent regulatory bodies include the Securities and Exchange Commission (SEC) in the United States, the European Central Bank (ECB) in the Eurozone, and the Financial Conduct Authority (FCA) in the United Kingdom. Each of these institutions has a specific mandate and jurisdiction, but all share the responsibility of overseeing the financial industry within their respective regions.

Challenges in Regulating Digital Finance

The rapid emergence of digital finance has presented regulators with unique challenges.

Unlike traditional financial systems, digital finance operates in a borderless environment. Cryptocurrencies and decentralized platforms can transcend geographical boundaries, making it difficult for regulatory bodies to assert control. This raises concerns about money laundering, fraud, and the potential for illicit activities facilitated by digital currencies.

Additionally, the pace of technological innovation often outpaces regulatory adaptation. Fintech companies continuously introduce new products and services, leaving regulators scrambling to keep up. Striking a balance between promoting innovation and maintaining control is a delicate task for regulatory bodies.

Moreover, the issue of data privacy and cybersecurity looms large in the digital finance arena. With vast amounts of sensitive financial information being exchanged electronically, regulators must ensure robust security measures are in place to protect consumers and institutions from cyber threats.

7. Conclusion

In conclusion, the evolution of finance is a testament to human adaptability and innovation. From ancient barter systems to the digital age of DeFi, finance has evolved to meet the changing needs of society. As we move forward, the financial industry will continue to transform, driven by technological advancements and a commitment to financial inclusion and sustainability.

+ There are no comments

Add yours